Tally with GST Training Course In Guntur

- Get Certified from the Best Tally with GST Training Institute in Guntur

- Get trained by 11+ Years experienced trainers.

- 10+ real-time projects.

- Lab facility.

Students Enrolled

Duration

Get In Touch With Us

Table of Contents

Best Tally with GST Training Institute in Guntur

Nipuna Technologies is one of the Best Tally with GST course in Guntur. This course is designed to meet all levels of student & working professionals requirements. Our Tally Training is generally a 1-2 months Training program where our students will understand Tally software in-depth and learn concepts related to inventory management, GST and TDS calculation, modifying company details, etc. Also various organizations use this software as it is easy to use and helps in keeping an error-free and glitch-free record of a companys accounts. This Software is an excellent choice for those who want to pursue a career in Accounting.

Get the best Tally with GST classe in Guntur. Our Tally course trainers are very experienced professionals and share their practical knowledge to the students with real-time Scenarios. Our highly skilled trainers will make sure you will learn & understand all aspects of this course content & they provide one-to-one care by listening and clarifying the doubts of each student.

Tally with GST Course Guntur: The Ultimate Accounting Course for Students in Guntur

When it comes to paving the way for a successful career in accounting, choosing the right educational path is crucial. In the contemporary world of finance, having a strong foundation in accounting software is imperative. This is where Tally with GST steps in, serving as the ultimate tally with GST course near me for students in Guntur. At Nipuna Technologies, we are dedicated to providing a comprehensive and industry-relevant learning experience, helping students learn Tally ERP with GST effectively.

Learn the Latest Accounting Software in Our Tally with GST Course Guntur

Staying current with the latest software is not only advantageous but essential in the rapidly changing field of accounting. The Tally ERP 9 with GST course we offer aims to provide students with practical skills in using the latest accounting tools, including sales entry in Tally with GST. Our curriculum is designed to take you from mastering the basics to understanding intricate transactions, ensuring that you are fully prepared for the job right from the start.

Our tally with GST course is designed to cater to both aspiring accountants and business owners who want to effectively manage their finances. It covers a comprehensive range of accounting principles. At our institution, we prioritize practical learning and ensure that our expert instructors present real-world scenarios to help you improve your problem-solving abilities.

Become a Certified in Tally with GST Course Guntur in Just 3 Months

For students who are eager to start their careers, time is extremely important. Our intensive Tally with GST programme offers the opportunity to learn Tally ERP with GST and become a certified professional in just three months. We acknowledge the importance of your time, and that’s why we have taken great care in designing our curriculum. Each module, including what is GST, has been carefully crafted to enhance your skill set.

Our instructors, well-versed in tally GST and tally ERP 9 GST, have extensive industry experience and will help you navigate the complex aspects of Tally and GST implementation. Our course comprehensively covers all aspects of accounting, including taxation and compliance, as well as financial statement management. It is designed to equip you with the necessary skills to excel in this field.

Job Prospects After Completing Tally ERP with GST Course Guntur

Tally ERP GST has emerged as the fastest-growing software of Tally that includes a real-time collection of financial data, offline data processing, and inbuilt reporting tools times. It is clear that there are endless possibilities in that area since companies hiring in various sectors.

After completing a Tally course in Vijayawada at Nipuna Technologies, you can work in the banking, billing, and taxation sectors, and also chances of getting hired for several job roles by multinational companies will increase exponentially.

Accounting Clerk

Accounting Associate

FAccounts Assistant

Accounts Executive

Accounts Officer

Accounting Clerk

Accounting Associate

FAccounts Assistant

Accounts Executive

Accounts Officer

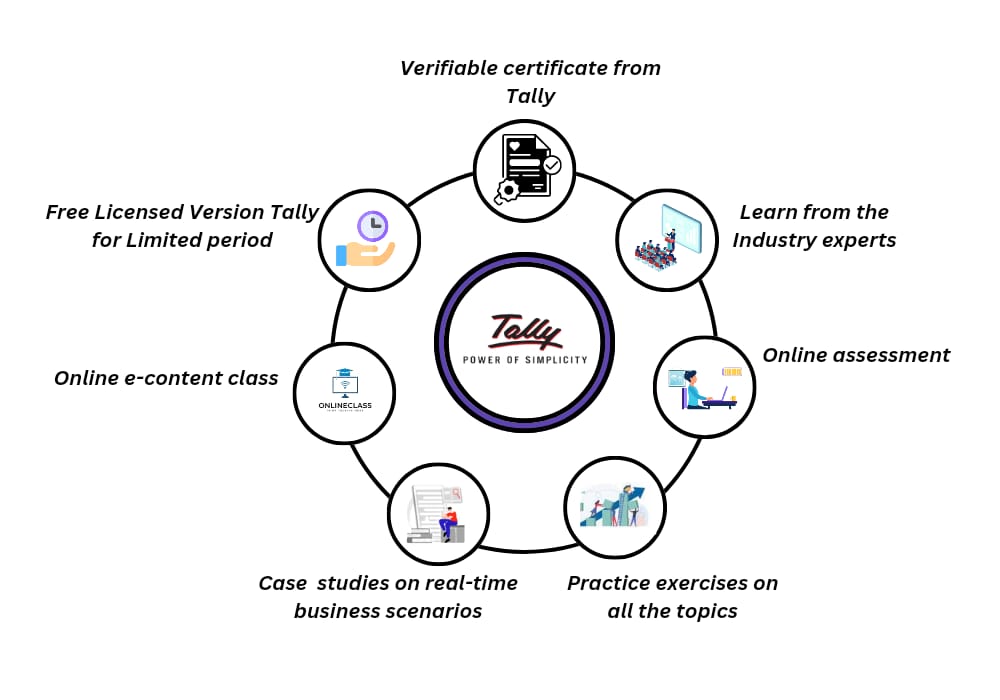

Why Choose Nipuna Technologies for Tally with GST Course Training in Guntur?

Our Tally with GST training program has been designed by expert trainers for students to get maximum in-depth knowledge with the support of our highly-skilled training team. This Tally course is totally placement-oriented with more prominence given to real-time exposure. Nipuna Technologies is the Best Tally GST class in Gunutr and offers job-oriented and placement Focused classrooms & Online Tally classes in Guntur. We provide A/C Class Rooms, High Configured Lab & well Experienced Trainers. We also offer students Tally with GST training classes who want to learn real-time applications by expert trainers in Guntur. Our Tally Course in Guntur at Nipuna Technologies is specially designed for both Graduates and working professionals.

Choose the Best Tally with GST Institute in Guntur for Your Student Budget

Investing in education is a way to invest in your future. Nipuna Technologies acknowledges the common financial limitations experienced by students. We provide the most comprehensive and affordable Tally GST course, also known as the Tally with GST course in Guntur, which is why it is considered the best option. The institute is known for its dedication to providing high-quality education. Our approach involves integrating classroom instruction with hands-on exercises and real-life illustrations, allowing our students to fully comprehend the concepts. Our programme emphasizes experiential learning to equip you with the necessary skills and knowledge for success in the accounting field.

GST stands for Goods and Services Tax, and our Tally GST course covers a wide range of topics, including tally question paper with GST, tally erp with GST, and tally GST entry. This comprehensive curriculum ensures that you are well-prepared to handle various aspects of accounting and taxation.

Tally with GST Course in Guntur - Key Features

Practice Labs For Real-Time Learning

Practice Labs makes it easy for you to put your learning into practice in a safe environment that you can access anytime with a compatible PC, Browser and Internet connection.

Live Project Training

We offer Live Projects and opportunity to take part in project design supported by industry partners including business and community organizations.

Classroom Training

We will use collaborative web conferencing with screen sharing to conduct highly interactive live online teaching sessions.

24/7 Support

Got queries? Our 24/7 support team will go extra mile so you can have easy and enjoyable experience with Nipuna Technologies on Slack which is a communication platform.

Job & Interview Assistance

Our interview assistance can help you overcome your fears and walk into your next interview with confidence and get your dream Job.

Internship After Course

Industry needs the best talent to stay afloat and thrive in today’s fast and ever-changing world, you will get a chance to do Internships and working closely that can provide a serious winwin for both Industry and students/trainees

Our Tally with GST Course in Guntur Contents

List of all the topics which will be covered in Tally with GST Course Guntur

MODULE

1 Tally ERP9 - Manual Accounts

1 Tally ERP9 - Manual Accounts

- Introduction to Manual accounts

- Basic Accounting terminology

- Accounting Concepts

- Golden Rules of Accounts

- Personal Account

- Real Account

- Nominal Accounts

- Journal Entries

- Single entry Method of Accounting

- Double Entry Method of Accounting

- Creation of accounting Ledgers

- Preparation of Trial balance

- Generating Reports

- Trading account

- Profit and loss account

- Balance sheet Reports

MODULE

2 Data Entry Work in Tally ERP9

2 Data Entry Work in Tally ERP9

- Creating The Company with security Features

- Selecting the company

- Altering the company

- Deleting the company

- Groups identification

- Ledger creation

- Single ledger

- Create

- Display

- Alter

MODULE

3 Print the accounting Reports

3 Print the accounting Reports

- Introduction to Stock summary

- Stock summary with Go downs

- Trial balances

- Trading account

- Profit and loss account

- Balance sheet

- Cash book

- Sales register

- Purchase register

- Cash flow statement

- Funds flow statement

MODULE

4 Financial Management in Tally ERP9

4 Financial Management in Tally ERP9

- Maintain Bill wise detail

- Bills receivabl

- Bills payable

- Interest calculations

- Interest payable

- Interest receivable

- Budget and controls with credit limit

- Scenario management

- Reversing journal

- Optional vouchers

- Consolidation of Balance Sheet Reports

- Point of sales

- Enable Cheque printing

- Set alter banking features

- Enable zero valued transaction

- Cost centers

- Cost centers Classes

MODULE

5 Inventory Management in Tally ERP9

5 Inventory Management in Tally ERP9

- Inventory vouchers

- Purchase Order Process

- Sales Order Process

- Bill of material with Manufacturing process

- Maintain separate discount column in invoices

- Maintain Batch wise details

- Maintain manufacturing Date and Expiry Date

- Track Additional cost of purchases in Tally ERP9

- Actual and billed Qty

- Zero valued entries

- Job order process

- Job work in order

- Job work out order

- Job costing

- Track cost for stock item

MODULE

6 Maintain Advanced MIS Reports

6 Maintain Advanced MIS Reports

- Cash flow statement

- funds flow statement

- Ratio analysis

- Aging analysis

- Movement Analysis

- Negative Stock

- Negative Reports

- Overdue receivables

- Overdue payables

MODULE

7 Technical Concepts in Tally ERP9

7 Technical Concepts in Tally ERP9

- Backup data

- Restore data

- Apply Tally vault password to existing company

- Apply Tally vault to newly created company

- Maintain multiple mailing details for company and ledgers

- How to Create security Controls in Tally Erp9

- Security control with Users

- Security control with Users with Audit features

- What is Split company Data

- You Will be Export data into various formats

- How to Import data into one company to another

MODULE

8 Taxation in Tally Erp9 Goods and Services Tax (GST)

8 Taxation in Tally Erp9 Goods and Services Tax (GST)

- What is Goods and Service Tax (GST)

- Understanding SGST, CGST & IGST

- Setting Up GST (Company Level, Ledger Level or Inventory Level)

- GST Slab Rates For Regular and composite dealers

- E-Way Bill

- GST for COMPOSITE Dealers

- Creating GST Masters in Tally

MODULE

9 Purchase Voucher with GST

9 Purchase Voucher with GST

- Intra-State Purchase transaction of GST (SGST + CGST)

- Inter-State Purchase transaction of GST (IGST)

- GST Purchases for Unregistered Dealers of India

- Reverse Charge Mechanism transaction of GST in Tally Erp9

MODULE

10 Sales Voucher with GST

10 Sales Voucher with GST

- Intra-State Sales transaction of GST (SGST + CGST)

- Inter-State Sales transaction of GST (IGST)

- Printing GST Sales Invoice from Tally ERP9 Software

MODULE

11 Tax Deducted at source (TDS)

11 Tax Deducted at source (TDS)

- Basic Concepts of TDS

- Configuring TDS in Tally Erp9

- Creation of TDS Masters

- Posting TDS Transaction in Tally Erp9

- TDS Payment Entry

- TDS Returns

Tally with GST Training Course Guntur Tools & Platforms

Our Reviews

Our Reviews

Related Courses

1 Power BI Course in Guntur

Data drives decision-making across industries in today’s fast-paced world. Learning to analyse and comprehend data has become an important skill that boosts professional chances. Business Intelligence, or Power BI Course in Guntur, is crucial in current environment. If you live in Guntur and want to improve your analytical skills, visit Nipuna Technologies.

2 Machine Learning with Python Course in Guntur

Expert trainers built our Machine learning with Python training programme to give students the most in-depth understanding with our highly qualified training team. This placement-focused machine learning course emphasises real-time exposure. Nipuna Technologies is the finest Machine learning with Python Training in Guntur, offering job-oriented and placement-focused classrooms and online courses.

3 AWS Course in Guntur

AWS DevOps jobs have increased due to this demand for competent professionals. Nipuna Technologies’ Advanced AWS DevOps Course in Guntur can help you excel in this dynamic sector and prepare you for a rewarding future in this field.

4 React JS Course in Guntur

Nipuna Technologies provides the top React JS Course in Guntur. This training caters to all student and professional needs. Expert Trainers lead Nipuna Technologies’ React JS Online Training, which helps students master React’s functionalities, components, and architecture.

5 CCNA Course in Guntur

Nipuna Technologies offers a CCNA Course in Guntur. We teach CCNA basics to advanced ideas in this course. Many IT jobs require networking. Knowledge and CCNA certification in this area will boost your work prospects. CCNA is a leading technology, and many small to mid-sized enterprises automate daily processes.

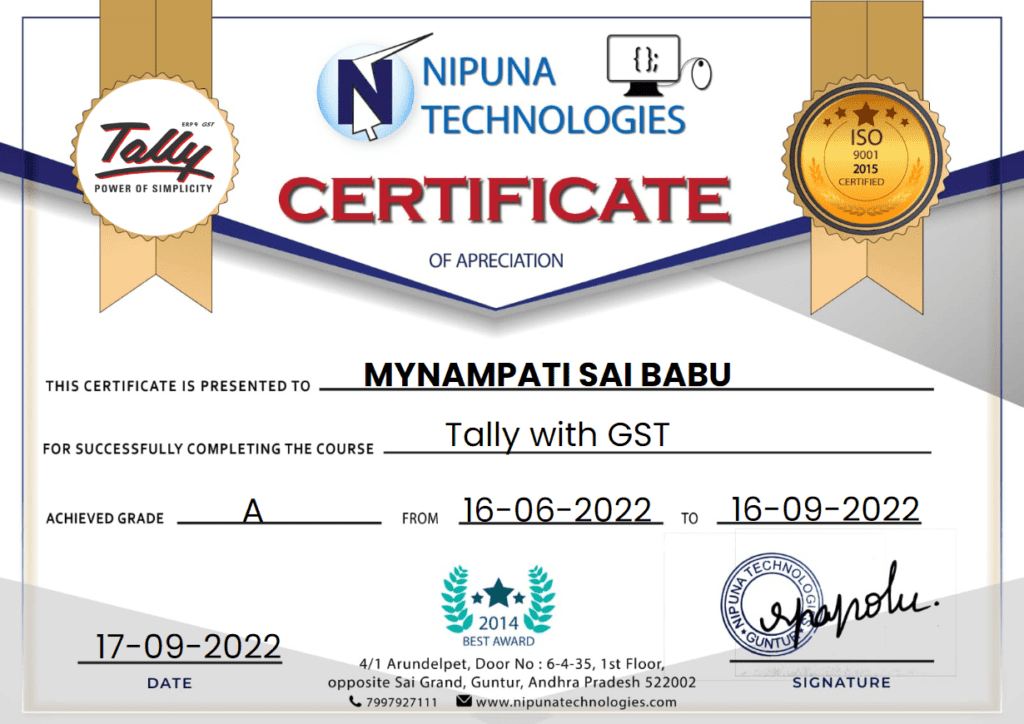

Tally with GST Certification Course in Guntur

CERTIFICATION

Our training is based on latest cutting-edge infrastructure technology which makes you ready for the industry. Nipuna Technologies will present this certificate to students or employee trainees upon successful completion of the course which will encourage and add to trainee’s resume to explore a lot of opportunities beyond position.

Frequently Asked Questions

What are the Qualifications for Tally GST courses Training?

Students must have completed secondary education, i.e. 10+2 or equivalent (preferably in Commerce stream)

Basic knowledge of Business Management and Accounting has added an advantage to the Tally course.

Students can also learn the course after they finish their graduation. This Tally course will act as a professional boost if you are planning to get a job in the field of Accounting.

What is Tally GST course?

ally software is an ideal solution for complete accounting, taxation, payroll, and monetary transactions recording. It’s being used by many business organizations to maintain their books of accounts. It also helps in record-keeping the business accounts very clear within the departments, which brings efficiency in transactions, task completion and reduces paperwork. By using Tally, you can avoid auditing errors and costly accounting. Because of its flexibility, it’s a choice of over 1 million businesses, including MNCs!

What comes in Tally course GST Training?

Learn the basics and Classification of Accounting.

Goods and Services Tax.

Company Formation.

Balance Sheet.

Ledgers.

Printing of Cheque.

Learn the Methods of Bank Reconciliation.

About Credit Limit.

Learn the rules of Taxation.

TDS and its Calculation.

Learn about Synchronization of Data.

Learn about Cost Centers and Cost Categories.

Learn Stock Analysis and Transfer.

Understand and Learn the GST Concepts.

Understand the Process of Sales and Purchased Order.

Learn about Contra, Journal, and Manufacturing Voucher.

How much does it cost to learn Tally?

The fees Structure of the course is the economical. However, please contact with us to obtain the discounted course fees.

Do you provide only tally course?

Why should I choose Nipuna Technologies for the Tally with GST course?

Is this course suitable for beginners with no accounting background?

What certification will I receive after completing the course?

Our Location:

Nipuna Technologies Guntur

- Door No : 6-4-35, 1st Floor, 4/1 Arundelpet, Opposite Sai Grand, Guntur, Andhra Pradesh 522002

- Monday-Sunday: 7am-10pm